What is crypto staking, and where is the best place to stake?

Here, you'll find everything about staking crypto and why you should consider getting started. Crypto staking rates can vary widely across exchanges, so we’ve compiled an overview of several crypto exchanges, covering the stakable coins, associated percentages, and their pros and cons. This allows you to compare staking conditions across exchanges and earn the highest interest rate on your cryptocurrency!

What is crypto staking?

In simple terms: Crypto staking is the process of "locking up" (staking) cryptocurrency with an exchange to earn a specific interest rate on your holdings. It's similar to putting money in the bank, where you earn positive interest.

In technical terms: Crypto staking is the process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain. Anyone with cryptocurrency can "stake" it to earn rewards for supporting the blockchain network.

Why stake cryptocurrency?

Crypto staking is considered one of the easiest ways to earn money with cryptocurrency. You receive a fixed percentage over a specific period. However, if the staked coin loses value during the staking period, you could lose money. Conversely, if the cryptocurrency appreciates during staking, you enjoy compound interest benefits! You can stake not only Bitcoin but also altcoins and stablecoins.

The staking rate (percentage) varies per cryptocurrency. This rate is based on factors such as risk (volatility), the process's complexity, and asset liquidity during the staking period. The appeal of crypto staking is that stablecoins with lower risks (e.g., USDT, USDC, or DAI) can yield higher interest, offering a higher return with less risk in traditional finance.

Example: The USDT price changed only 0.3% over the past year, while its staking rate across exchanges ranges from 6% to 12%. In contrast, Bitcoin’s price fluctuated over 400%, and its staking rate varies between 1% and 6.5% on different exchanges.

Where can you stake crypto?

Crypto staking can be done in various ways. The safest is through a hardware wallet, though this requires technical knowledge. A more straightforward option is using crypto exchanges, where you can earn interest on your crypto with just a few clicks.

Nearly every crypto exchange in 2025 offers staking or savings options. Some provide staking only, while others include products like Launchpool or Dual asset staking. Always review the conditions and understand how the staking protocol works before locking your crypto in more complex staking products.

From a Hong Kong user perspective, the Launchpool and Dual asset staking are often not available. The local regulated exchanges don't offer these features and international exchanges as Binance have blocked those features for people who registered with a HKID. As a result, we will not take those into consideration for this acticle.

Nexo Fixed Term Saving

Nexo can be seen as an “earning platform,” or in other words, a purely saving & staking platform. It is a regulated institution where you can swap, stake and save cryptocurrency.

Advantages of Nexo:

- Supports a wide range of cryptocurrencies, allowing you to store assets in your wallet or purchase crypto easily with a credit card.

- Offers advanced trading and Over-The-Counter (OTC) options.

The company’s mission is to maximize the value and utility of cryptocurrency. This has resulted in an ecosystem that has processed over $130 billion through a user base of more than 7 million worldwide.

Nexo claims to have military-level security with 256-bit encryption and insurance coverage of $375 million for potential user damage. Customer assets are stored in cold wallets, enhancing protection against hackers. Additionally, Nexo is one of the few companies qualified and audited by BitGo, which is supported by Goldman Sachs.

Interested in NEXO?

Click the button below to go directly to NEXO and receive a welcome bonus!

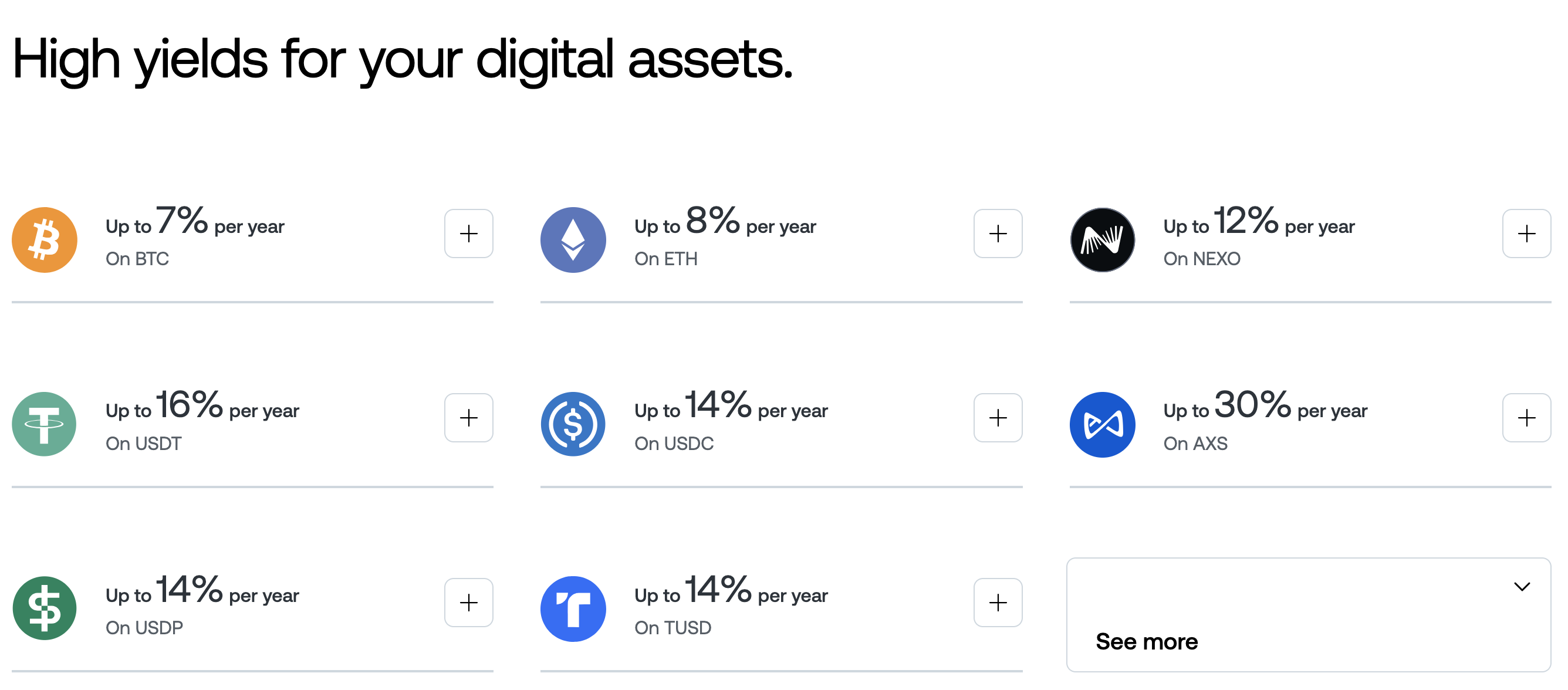

Nexo Savings Rate Rates

The maximum interest rate on stablecoins (USDT/USDC) at Nexo is 16%. To qualify, you need to reach platinum status, which requires that 10% of your portfolio consists of NEXO tokens, the platform’s native token. Here’s a breakdown of the status levels:

- Platinum Status: 10% NEXO tokens in your portfolio – max interest rate.

- Gold Status: 5-10% NEXO tokens in your portfolio.

- Silver Status: 1-5% NEXO tokens in your portfolio.

- No NEXO Tokens: 12% on stablecoins, still a substantial rate.

Below is an example of the interest rates with “platinum status”:

Binance Staking

Binance Staking allows users to earn rewards on their idle cryptocurrency holdings by participating in staking directly on the Binance platform. With support for a variety of Proof-of-Stake (PoS) assets, Binance Staking offers flexible and locked staking options, designed for users who want to grow their holdings without actively trading.

Benefits of Binance Staking

- Wide Selection of Assets: Binance supports staking for popular cryptocurrencies like Ethereum (ETH), Cardano (ADA), Polkadot (DOT), and many more.

- Flexible and Locked Staking: Choose between short-term flexibility or higher rewards with locked staking periods.

- No Technical Setup: Binance takes care of all staking infrastructure, so you can earn rewards without the need for a personal staking node.

Security and Transparency

Binance uses top-notch security measures, including cold storage for user funds, while staked assets are protected and managed on Binance’s secure platform.

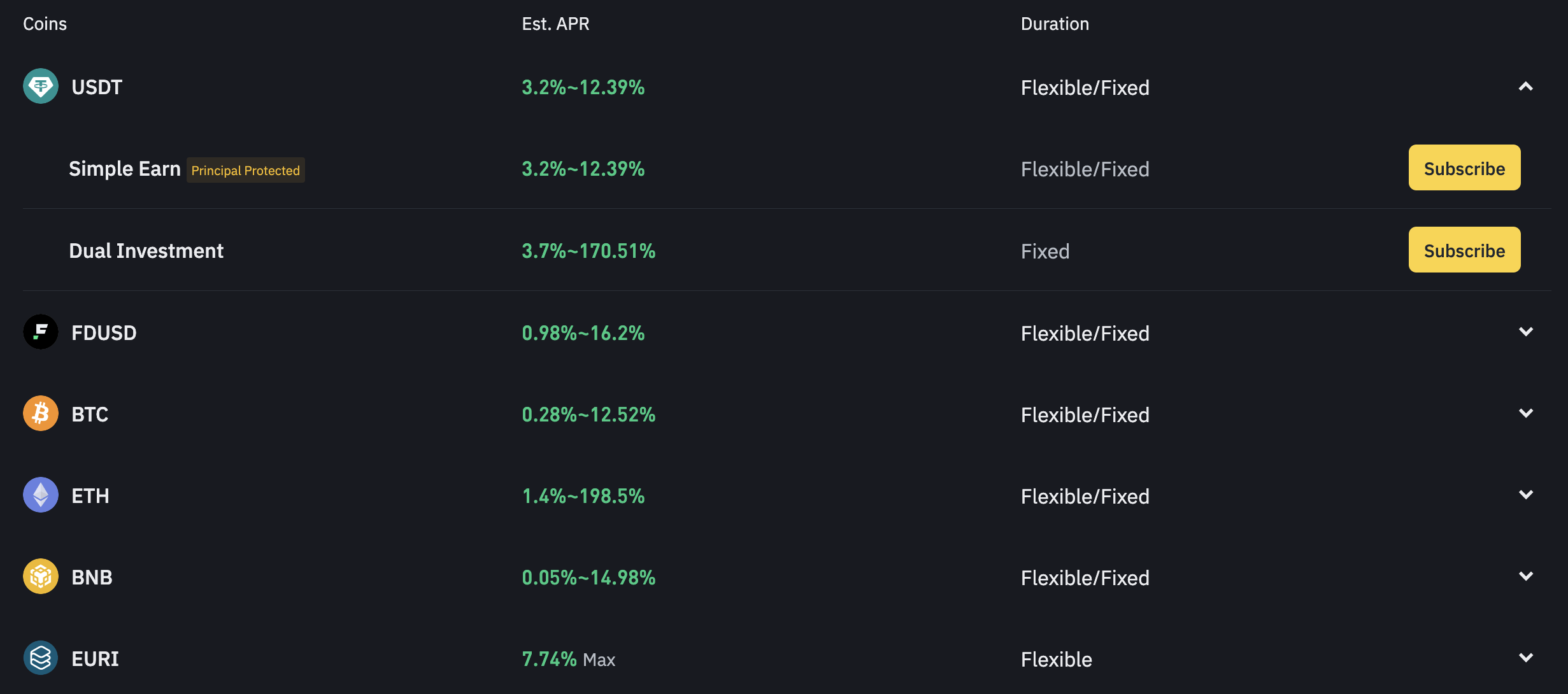

Interest Rates and Reward Tiers

Binance Staking rewards vary depending on the asset and staking duration, with higher returns for longer lock-up periods. Here’s an example of potential staking rewards. Within Binance, this is all categorised under the "Earn" programme:

- Flexible Staking: Earn rewards without committing to a set time period, though at a slightly lower rate.

- Locked Staking: Choose terms like 15, 30, 60, or 90 days for higher yields. For instance:

- 30-Day Locked Staking on certain stablecoins can yield up to 10% APR.

- 90-Day Locked Staking options offer some of the best rates on major tokens.

Ready to Start Staking on Binance?

Click below to create an account and start earning rewards on your crypto today.

Crypto.com Staking

Crypto.com offers a streamlined staking platform that lets users earn rewards on a variety of cryptocurrencies. With support for over 30 digital assets, Crypto.com Staking provides options for flexible or term staking, allowing users to earn higher returns based on their staking term and CRO (Crypto.com Coin) holdings.

Benefits of Crypto.com Staking

- Diverse Asset Support: Stake popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Polkadot (DOT), among others.

- Flexible & Term Options: Choose between flexible staking with no lock-up or higher rates on terms of 1, 3, or 6 months.

- Enhanced Rewards for CRO Holders: Users who stake Crypto.com Coin (CRO) receive increased APR on other assets.

Security and Reliability

Crypto.com uses high-security standards, including cold storage for funds and a $750 million insurance policy to protect staked assets.

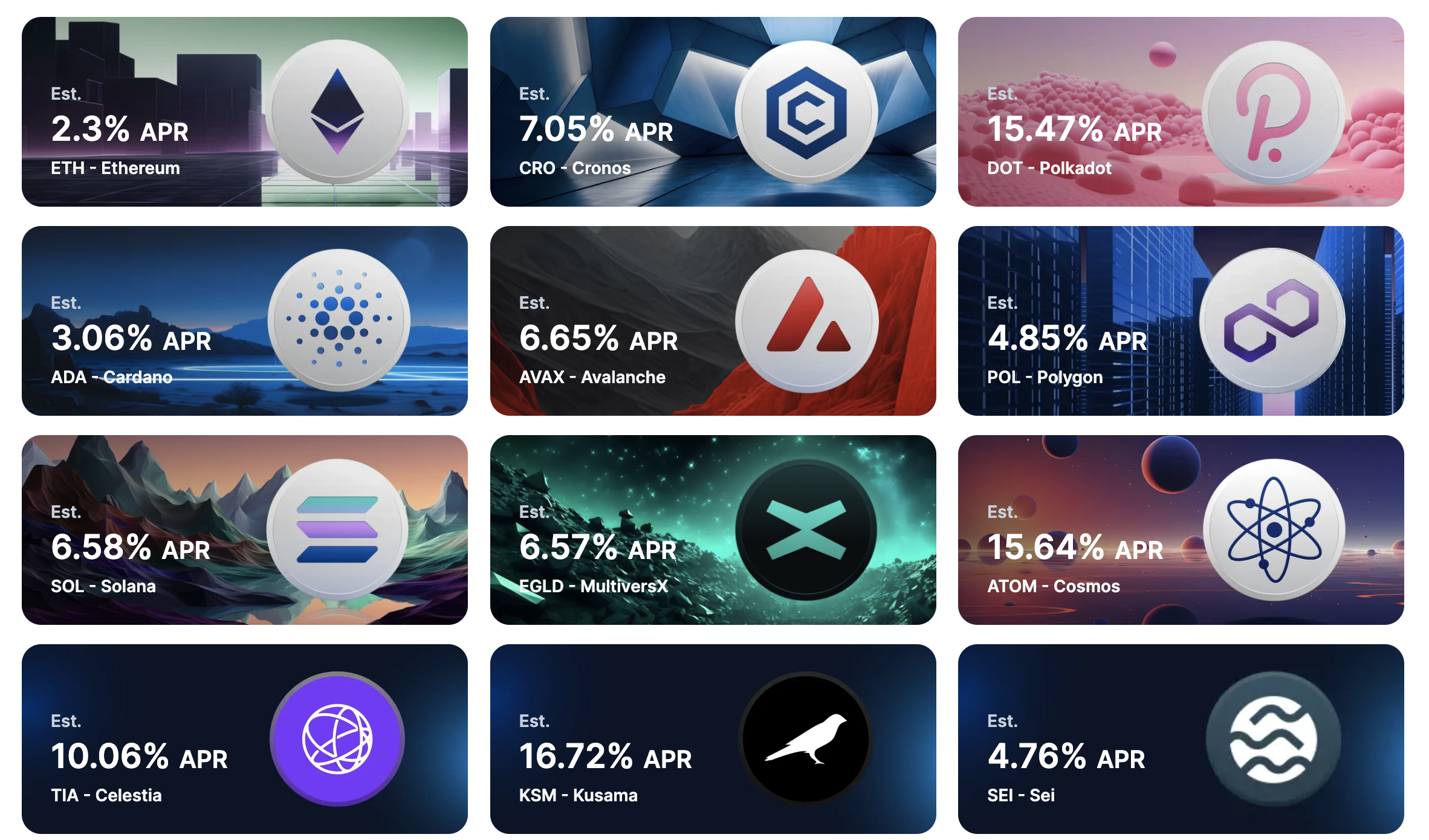

Interest Rates and Reward Tiers

Crypto.com’s staking rewards depend on the staked asset, duration, and the user’s CRO holdings. Users who stake CRO can unlock the highest reward tiers. Examples include:

- Flexible Staking: Earn rewards with the option to withdraw any time.

- Locked Staking (3 or 6 months):

- 3-Month Staking: Potentially up to 6% APR on major coins.

- 6-Month Staking: Can yield even higher rates, depending on CRO holdings.

Check the latest Crypto.com Staking Rates for detailed rate information.

Ready to Stake with Crypto.com?

Click below to create an account and maximize your crypto holdings today!

COMING SOON: OKX Staking

COMING SOON: eToro Staking

Conclusion on Crypto Staking

Crypto staking is something we recommend to everyone, as it allows you to earn a fixed return on your cryptocurrency with minimal effort. You can manage your crypto holdings on earning platforms like YouHodler and NEXO, which offer high interest rates on your cryptocurrency. On these platforms, you can even borrow money or crypto assets. However, always be aware that there are risks involved with crypto staking!

A challenge remains to find Staking options while located in Hong Kong. Crypto.com and OKX are making it very difficult to use the platform with a Hong Kong IP and with a Hong Kong ID. So unless you have a different nationality and a VPN, it's almost impossible to use.

Therefore we have our two top options which are Nexo and Binance, they are simply the best staking platforms for your crypto in 2025.

If by any chance you do not trust the crypto exchange platforms, you can always go the Ledger option. You can stake Solana, Ethereum and many other Proof of Stake Blockchains directly from your Ledger Wallet, which will give you the option to by pass the exchanges directly.