- 1. What is a crypto wallet?

- 2. How do crypto wallets work?

- 3. Different types of crypto wallets

- 4. Web3 Exchange Wallets

- 5. Best Web3 Exchange Wallet

- 6. Hardware Wallets

- 7. Best Hardware Wallets

- 8. Decentralized Software Wallets

- 9. MetaMask & TrustWallet

- 10. Conclusion: What to consider when choosing a crypto wallet?

Crypto Wallets - What is a Wallet and Do You Need One in 2025?

What is a crypto wallet?

Cryptocurrency is a completely digital way to store and transfer value. You've likely heard of decentralization and blockchain technology in this context. Decentralization means there's no central authority, like a bank, managing your money or assets. Instead, you need to manage this yourself using a crypto wallet.

Wallets can seem complex, but when you send or receive cryptocurrency, it's always done through a wallet. If you trade on a crypto exchange like Binance, Hashkey or OSL, you automatically have a wallet on the exchange for trading. However, an exchange wallet is very different from an external, standalone hardware wallet.

You don’t necessarily need an external wallet to store your cryptocurrency. Crypto exchanges let you store coins like Bitcoin, Ethereum, and Solana directly on the platform, much like stock brokers do. For security reasons, however, you might want to consider an external hardware wallet.

How do crypto wallets work?

A cryptocurrency wallet consists of two main elements: a private key and a public key.

- Private Key: This is like your wallet's "password," a long and complex combination of letters and numbers. Keep it secret as it grants access to your wallet.

- Public Key: This is the wallet's public address, used for receiving or sending cryptocurrency. Since it's public, you can safely share it for transactions.

On exchanges like Binance, Hashkey or OSL, the private key is stored securely by the exchange and is not shared with you. With hardware or decentralized software wallets, you are given the private key, giving you full control over your assets rather than relying on the exchange.

Different types of crypto wallets

In addition to exchange wallets, there are generally two types of decentralized wallets:

- Web3 Exchange Wallets

- Hardware Wallets (also known as “cold” wallets)

- Software Wallets (also known as “hot” wallets)

Web3 Exchange Wallets

Crypto exchange wallets are slightly different from standalone hardware wallets. Exchanges often store private keys for you, so you don’t have to manage them. However, for users who want to control their own keys, Web3 exchange wallets offer an option. These are external wallets managed by the user but still linked to an exchange.

Almost all exchanges now have sufficient security measures to protect your individual account from being compromised. If you haven’t already, make sure to set up Multi-Factor Authentication, Email 2FA, and whitelist your withdrawal addresses on your exchange account.

However, none of these security features can safeguard you if the exchange gets compromised. To protect yourself from these risks, you should move your crypto off the exchanges.

In crypto, there's a saying:

"Not your key, not your Crypto."

This means that if you do not control your own keys, how can you be sure you truly own your Crypto?

Benefits of Web3 exchange wallets

- Easier to use than external hardware or other software wallets.

- Familiar interface from the exchange.

- Quickly switch between a central and decentralized environment with secure verification.

Downsides of Web3 exchange wallets

- Requires entering private keys online, which can expose you to cyber risks.

- No hardware verification, and recovery phrases may be hard to back up.

Best Web3 Exchange Wallet

1) Binance Web3 Wallet

The Binance app now offers a fully decentralized environment where users hold their private keys. It’s user-friendly and lets you swap crypto, trade NFTs, and even earn interest.

1) OKX Web3 Wallet

Similar like Binancen, The OKX app now offers exactly the same features. You can hold your own private keys. And it’s user-friendly and lets you also swap crypto, trade NFTs, and even earn interest.

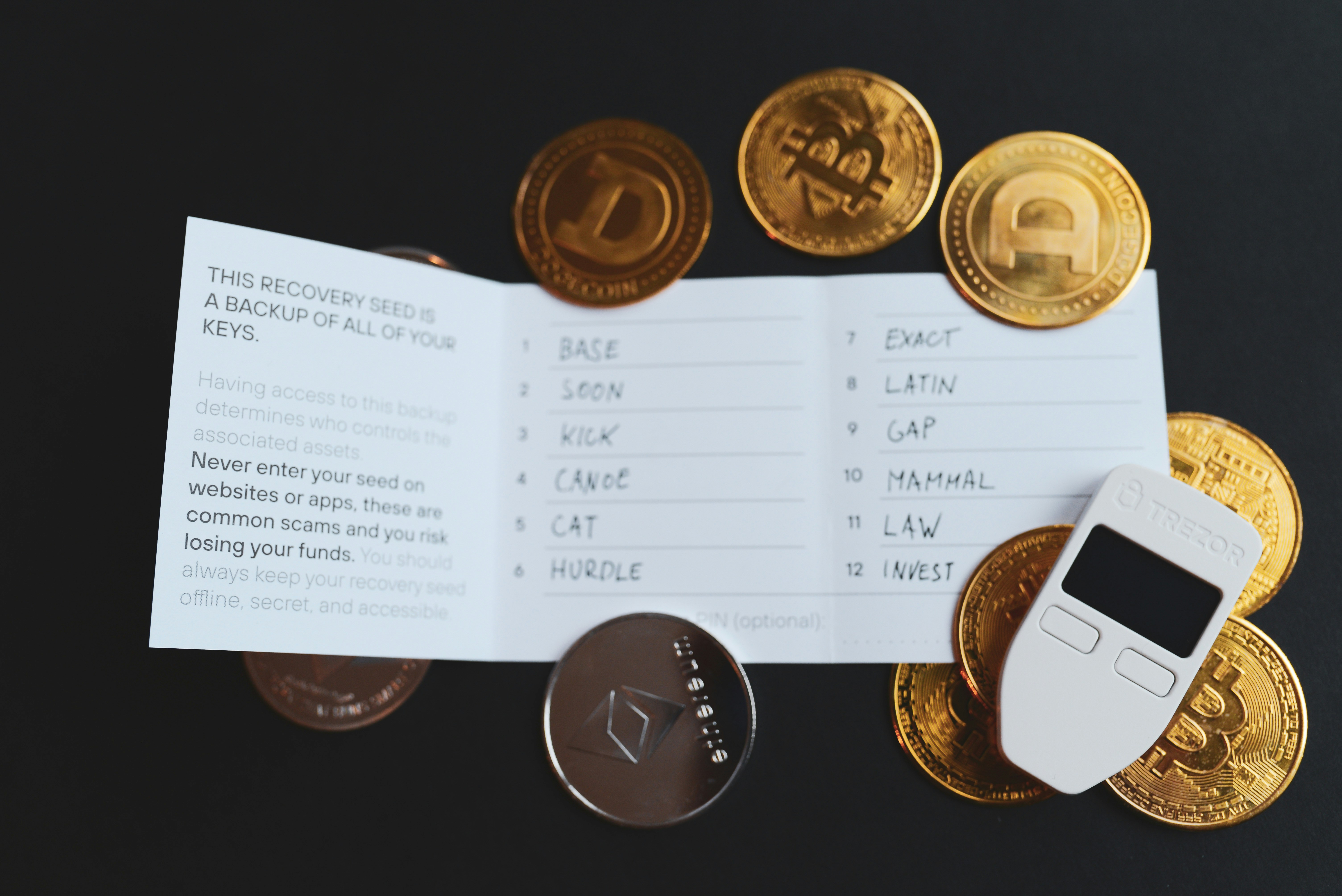

Hardware Wallets

Hardware wallets are physical devices, often resembling a USB stick, used to store cryptocurrency offline. When the wallet is disconnected from the computer, it’s completely secure from hacking.

Benefits of a hardware wallet

- Best protection: Prevents theft and hacking.

- Private keys remain private: Keys are only entered into the hardware wallet and not online.

- Virus-proof: Not vulnerable to malware targeting system software.

- Hardware verification: Crypto transactions require physical device verification.

Downsides of a hardware wallet

- Less user-friendly than exchange or software wallets.

- Requires an upfront purchase.

- Risk of forgetting recovery phrases or losing backup options.

Best Hardware Wallets

1) Ledger

The Ledger Nano S Plus and Nano X are popular options, priced at 79 and 149 USD, respectively.

2) Trezor

Trezor is highly secure and affordable, with prices varying from 49 to 169 USD. Many users also buy steel capsules to protect recovery phrases from damage, even in extreme conditions like fires.

3) KeepKey

KeepKey is a lesser-known option with an appealing design and lower price.

Decentralized Software Wallets

Decentralized software wallets are apps that let you manage your crypto independently. They’re encrypted and require a password to access funds. You’re also given a recovery phrase, allowing you to reset your wallet if you forget the password or lose access.

Benefits of a software wallet

- Safer than a centralized exchange wallet.

- Accessible and easy to use for transactions.

- Usually free and available as apps or browser extensions.

Downsides of a software wallet

- Online and potentially vulnerable to malware.

- Risk of losing access if recovery phrase is forgotten or lost.

MetaMask & TrustWallet

Popular decentralized software wallets like MetaMask and TrustWallet are reliable and offer integration with Dapps and decentralized exchanges.

Conclusion: What to consider when choosing a crypto wallet?

When choosing a crypto wallet, security is the top priority. Online exchange wallets (like Bitvavo) are user-friendly but less secure than offline, external hardware wallets. If you don’t have control over your private keys, you don’t truly control your cryptocurrency.

For long-term storage (HODLing), consider using a hardware wallet. This can help you avoid emotional reactions in volatile markets, as trading is less convenient with a hardware wallet.

Recommendation: For secure storage, consider using a Ledger Wallet. By using this referral link, you will get up to 20 USD discount on your purchase!

| Wallet Type | Description | Pros | Cons |

|---|---|---|---|

| Hardware Wallet | Physical device that stores your crypto offline. | - Very secure - Resistant to malware - Private keys are offline |

- Costly - Can be lost or damaged - Less convenient for frequent transactions |

| Software Wallet | Applications (desktop or mobile) for managing crypto. | - User-friendly - Convenient for frequent use - Can be free |

- Vulnerable to malware - Private keys stored online - Less secure than hardware wallets |

| Web Wallet | Online services that store your crypto. | - Accessible from anywhere - Easy to use - No installation required |

- Vulnerable to hacking - Control over private keys often lies with the provider - Dependent on internet access |

| Paper Wallet | Physical printout of your public and private keys. | - Very secure if created and stored properly - Immune to online threats |

- Can be easily lost or damaged - Not convenient for transactions - Requires careful handling |

| Mobile Wallet | Wallet apps for smartphones. | - Highly convenient - Often includes QR code scanning - Good for small transactions |

- Vulnerable to mobile malware - Requires internet connection - Risk of losing phone |

| Custodial / Exchange Wallet | Wallets managed by a third party | - Easy to use - Backup and recovery options - Typically user-friendly |

- You don’t control your private keys - Vulnerable to exchange hacks - Regulatory risks |